Join us at the SV Studio as we step into the captivating world of Non-fungible tokens (NFTs) as The StartupsVibes Docu-Series embarks on a thrilling exploration of the current state of digital ownership. In 2021, NFTs dominated headlines, capturing the imaginations of creators, collectors, and investors worldwide. From multi-million-dollar art sales to celebrity endorsements, NFTs were hailed as the future of digital ownership. However, as the bear run took hold and the initial frenzy subsided, speculation arose: Are NFTs dead?

Join us as we delve deep into the heart of the NFT phenomenon, unraveling its meteoric rise, the challenges it faces, and the innovative trends shaping its future. From the underlying technology driving NFTs to their diverse applications across industries, our docu-series leaves no stone upturned. But amidst the criticisms and uncertainties, one thing is clear: the NFT revolution is far from over. So buckle up and get ready for a wild ride as we navigate the twists and turns of the NFT landscape, where the possibilities are endless and the excitement is palpable.

The NFT Boom: A Meteoric Rise

Non-Fungible Tokens (NFTs) witnessed an unprecedented surge in popularity, capturing the imagination of both creators and investors alike. The phenomenon can be traced back to key moments such as the sale of Beeple’s digital artwork for a staggering $69 million, which catapulted NFTs into the mainstream spotlight. Subsequent multi-million-dollar sales of digital art, music albums, and even tweets by celebrities and tech moguls further fueled the frenzy. This meteoric rise showcased the potential of NFTs to revolutionize the art and entertainment industries by providing a secure and decentralized platform for digital ownership.

However, with the rapid growth of the NFT market came inevitable criticisms and concerns. Environmental activists raised alarms about the significant carbon footprint associated with blockchain technology, particularly in the case of proof-of-work cryptocurrencies like Ethereum, upon which many NFTs are based. Moreover, skeptics questioned the authenticity and value of digital assets, arguing that owning a tokenized version of a digital file does not equate to true ownership or scarcity. These early criticisms foreshadowed a period of correction and introspection within the NFT ecosystem.

The NFT Ecosystem: An Overview

Editor’s Choice

At its core, the NFT ecosystem revolves around blockchain technology, which provides a transparent and immutable ledger for tracking ownership and provenance of digital assets. Various platforms and marketplaces have emerged to facilitate NFT transactions, offering creators and collectors a range of options for minting, buying, and selling digital tokens. Beyond the realm of art, NFTs have found applications in gaming, music, virtual real estate, and even identity verification. This diversification has contributed to the resilience of the NFT market, ensuring its relevance across multiple industries.

Despite the initial hype surrounding NFTs primarily within the art world, their potential for broader adoption and utility is becoming increasingly evident. Projects integrating NFTs into gaming experiences allow players to truly own in-game assets and monetize their skills, while musicians explore new revenue streams through tokenizing their albums and merchandise. Moreover, the concept of virtual real estate has opened up entirely new avenues for digital communities and social interactions. As the NFT ecosystem continues to evolve, its versatility and adaptability are proving essential in sustaining interest and engagement beyond the initial speculative phase.

The Initial Backlash: Environmental Concerns and Criticism

Despite the initial excitement surrounding NFTs, the technology faced significant backlash, particularly regarding its environmental impact. Criticisms centered on the energy-intensive nature of blockchain transactions, especially those on networks utilizing proof-of-work consensus mechanisms. The high computational power required for mining and validating transactions on these networks led to concerns about carbon emissions and environmental sustainability. This scrutiny prompted discussions within the NFT community about transitioning to more eco-friendly blockchain alternatives or implementing sustainability measures to mitigate environmental harm.

Additionally, NFTs faced criticism related to their perceived lack of intrinsic value and authenticity. Detractors argued that tokenizing digital assets does not confer true ownership or scarcity, as the underlying files remain infinitely reproducible. This skepticism raised questions about the long-term viability of NFTs as investments and assets, highlighting the need for greater transparency and trust within the ecosystem. Amidst these challenges, the NFT market experienced a period of introspection and adaptation as stakeholders sought to address concerns and build a more sustainable and robust foundation for the technology’s future growth.

NFTs in Flux: From Boom to Correction

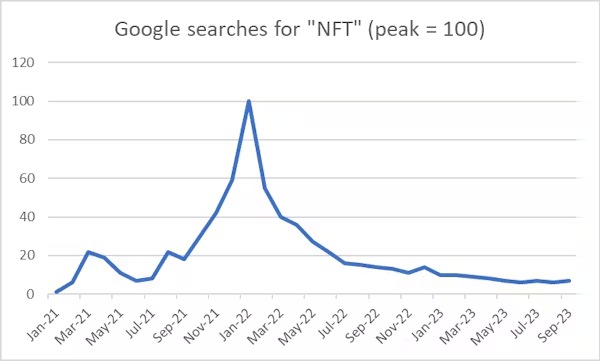

Following the initial euphoria surrounding NFTs, the market experienced a notable correction as the hype subsided and investor sentiment shifted. Trading volumes and sales figures, which had soared to unprecedented levels during the peak of the boom, began to decline. This downturn was accompanied by a decrease in media coverage and public attention, reflecting a broader cooling-off period for the NFT market. Some interpreted this correction as a sign of the NFT bubble bursting, while others viewed it as a natural phase of market maturation and consolidation.

Despite the market correction, signs of resilience and adaptation emerged within the NFT ecosystem. Creators and collectors continued to explore new avenues for monetization and expression, while platforms and marketplaces innovated to improve user experiences and address underlying challenges. The correction provided an opportunity for the NFT market to recalibrate and refocus on fundamentals such as utility, authenticity, and community engagement. As a result, while the initial hype may have waned, the underlying potential of NFTs to transform digital ownership and creativity remained intact, signaling a shift towards a more sustainable and mature phase of development.

Evolving Trends: NFTs Adapt and Innovate

Editor’s Choice

Amidst the market correction, NFTs continued to evolve, adapting to changing trends and exploring new avenues of innovation. One notable trend was the integration of NFTs into gaming and virtual reality experiences, offering players true ownership of in-game assets and fostering vibrant digital economies. This convergence of NFTs and gaming not only provided new revenue streams for developers but also enhanced player engagement and immersion. Additionally, fractional ownership emerged as a novel concept within the NFT space, allowing collectors to own fractions of high-value assets and democratizing access to rare and valuable digital items.

Community-driven projects also gained prominence, with creators leveraging NFTs to engage with their audiences and foster collaborative art initiatives. By involving collectors in the creative process and offering unique incentives such as royalties or governance rights, these projects cultivated dedicated fan bases and generated sustainable revenue streams. Furthermore, the emergence of cross-chain interoperability solutions facilitated seamless token transfers across different blockchain networks, increasing liquidity and expanding the reach of NFTs. These evolving trends underscored the adaptability and resilience of the NFT ecosystem, paving the way for continued innovation and growth in the digital ownership landscape.

Institutional Interest: The Quiet Revolution

While much attention has been focused on individual collectors and creators in the NFT space, institutional interest has quietly been growing behind the scenes. Major corporations and brands have begun to explore NFTs as a means of enhancing their marketing efforts, engaging with their audience, and monetizing their intellectual property. High-profile collaborations between established brands and NFT platforms have resulted in the tokenization of iconic artworks, collectibles, and digital assets, further legitimizing the NFT market in the eyes of mainstream audiences.

Moreover, institutional investors have started to recognize the potential of NFTs as alternative investments and assets. Funds dedicated to digital assets and blockchain technology have allocated capital to NFT-related projects and platforms, signaling confidence in the long-term prospects of the technology. The involvement of institutional players brings additional credibility and liquidity to the NFT market, paving the way for broader adoption and integration into traditional finance. As NFTs continue to attract interest from both individual and institutional investors, the stage is set for a new era of growth and maturation in the digital ownership space.

NFTs Beyond Speculation: Utility and Long-Term Value

As the NFT market matures, there is a growing emphasis on the utility and long-term value proposition of digital assets. Beyond speculative trading and investment, stakeholders are increasingly focused on leveraging NFTs for practical applications and tangible benefits. One key advantage of NFTs lies in their ability to provide transparent and immutable proof of ownership, facilitating the authentication and transfer of digital assets with ease and security. This has significant implications for industries such as art, where provenance and authenticity are paramount, as well as for digital collectibles and virtual goods, where ownership rights can be easily verified and enforced.

Furthermore, NFTs offer creators new opportunities for monetization and revenue generation, enabling them to tokenize their work and receive royalties each time it is bought, sold, or used. This provides a sustainable income stream for artists, musicians, and other content creators, while also empowering them to maintain control over their intellectual property. Additionally, NFTs can serve as a means of fostering community engagement and participation, with creators incentivizing their audience to interact with and support their work through token-based rewards and incentives. By focusing on the utility and long-term value of NFTs, stakeholders are laying the groundwork for a more resilient and sustainable digital ownership ecosystem.

The Future of NFTs: Challenges and Opportunities

Looking ahead, the future of NFTs is rife with both challenges and opportunities. One of the primary challenges facing the NFT ecosystem is scalability, particularly as the demand for digital assets continues to grow. Current blockchain networks face limitations in terms of transaction throughput and fees, hindering the seamless exchange of NFTs at scale. Addressing scalability issues will be crucial for unlocking the full potential of NFTs and ensuring their widespread adoption across industries.

Moreover, regulatory uncertainty looms as governments grapple with how to classify and regulate NFTs within existing legal frameworks. Clarifying regulatory guidelines will be essential for providing clarity and confidence to market participants, thereby fostering a conducive environment for innovation and investment. Additionally, ensuring the security and integrity of NFT transactions will be paramount in building trust and mitigating risks associated with fraud and cyber attacks.

Despite these challenges, the opportunities presented by NFTs are vast and promising. From transforming the way we perceive and interact with digital assets to revolutionizing industries such as art, gaming, and finance, NFTs have the potential to reshape the digital landscape in profound ways. As technology continues to evolve and new use cases emerge, NFTs will likely play an increasingly integral role in the digital economy, offering creators, collectors, and investors unprecedented opportunities for innovation, creativity, and value creation. By navigating the challenges and seizing the opportunities presented by NFTs, stakeholders can help shape a future where digital ownership is more inclusive, transparent, and empowering for all.

Conclusion:

In conclusion, the trajectory of Non-Fungible Tokens (NFTs) has been one of rapid ascent followed by a period of correction and introspection. From the initial hype that propelled NFTs into the mainstream spotlight to the subsequent market correction and maturation, the journey of NFTs reflects the dynamic nature of emerging technologies. While some may interpret the cooling-off period as a sign of NFTs’ demise, a more nuanced perspective reveals a landscape ripe with potential and opportunity.

Despite facing challenges such as environmental concerns, scalability issues, and regulatory uncertainties, NFTs continue to evolve and adapt to changing trends and market dynamics. The underlying technology of blockchain provides a transparent and immutable ledger for tracking ownership and provenance, offering new possibilities for creators, collectors, and investors alike. Moreover, the diversification of NFT applications beyond art into gaming, music, virtual real estate, and beyond underscores the versatility and resilience of the NFT ecosystem.

Looking ahead, the future of NFTs is promising, with opportunities for innovation, creativity, and value creation abound. By addressing challenges such as scalability and regulatory uncertainty while leveraging the opportunities presented by NFTs, stakeholders can help shape a future where digital ownership is more inclusive, transparent, and empowering for all. While the initial hype may have subsided, the underlying potential of NFTs to transform industries and redefine the concept of ownership in the digital age remains intact. As the NFT ecosystem continues to evolve, it is not a question of whether NFTs are dead, but rather how they will continue to evolve and shape the future of digital ownership.

Read Also: Addressing Low Female Venture Capital Funding