Growing Reliance on Digital Payments in Pharmacies

A recent report from Moniepoint has revealed a significant shift in how Nigerians pay for medicines, with over 45.39% of customers now using digital channels. This increase in digital payments is part of a broader trend that has reshaped the payment landscape for businesses across Nigeria, especially in pharmacies, where 80% of pharmacies now pay their suppliers digitally.

The report, titled “Inside Nigeria’s Community Pharmacies,” highlights the growing preference for digital payment methods like Point of Sale (PoS) systems and bank transfers. The reliance on these methods underscores the country’s increasing move towards a cashless economy, particularly after the cash crunch crisis of 2023, which saw many Nigerians abandon cash payments due to scarcity.

The Impact of the 2023 Cash Crisis

The cash scarcity in 2023 forced many Nigerians and businesses to switch to digital payment methods, spurring the growth of cashless transactions. Data from the Nigeria Inter-Bank Settlement System (NIBSS) showed a 45.41% year-on-year rise in cashless transactions in January 2023, reaching N39.58 trillion. By the end of the year, this figure had skyrocketed to over N600 trillion, demonstrating the lasting impact of the cash crunch on Nigeria’s payment systems.

Pharmacy owners and workers experienced this shift firsthand. Rita from Rite Life Pharmacy shared her experience during the cash scarcity: “The cash scarcity period was not a funny time. Customers would send money, show me a debit alert, and I’d be waiting for hours before seeing the alert on my end.” This highlights the teething problems with the digital payment infrastructure at the time, although the situation has since improved.

Digital Payments Become the Norm for Pharmacies

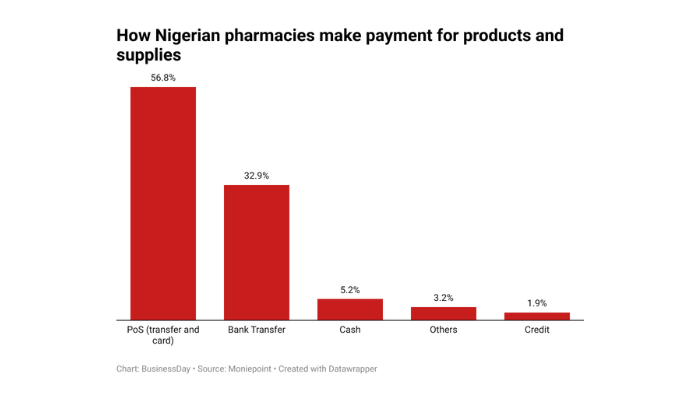

Moniepoint’s report further reveals that 80% of pharmacies in Nigeria pay for goods digitally. Of these, 56.8% use PoS machines for card payments and transfers, while 32.9% rely on direct bank transfers. Only 5.2% of pharmacies still pay for goods with cash, while a small percentage (3.2%) explore other payment methods, and 1.9% make use of credit facilities.

Chi, founder of Dexta Pharmacy, explained why digital payments have become the norm: “We typically deal with large sums of money, so it’s not wise to carry cash around.” Samson, the founder of Taobab Pharmacy, reinforced the importance of maintaining smooth payment systems: “When running a pharmacy, there are two sets of people you must never owe: your staff and your suppliers. I can’t go too deep right now, but just know your business will get in trouble.”

Customer Preferences and the Opportunity for Pharmacies

According to the report, nearly half a million customers make purchases at Nigerian pharmacies daily. Of these, only 7.69% prefer to pay exclusively with cash, while 45.39% pay digitally. A significant portion, 46.92%, use a combination of cash and digital methods. This growing reliance on digital payments presents a unique opportunity for pharmacies to enhance the payment experience for both existing and new customers.

SEE ALSO: Moniepoint Microfinance Bank Introduces Multifactor Authentication to Enhance Payment Security

Moniepoint’s report emphasizes the potential for pharmacies to strengthen customer relationships through reliable and efficient payment options: “Adopting reliable payment methods can enhance relationships with existing customers and help to build strong relationships with new ones,” the report states.

The Future of Digital Health in Nigeria

As digital payments gain traction in the pharmacy sector, the broader digital health market in Nigeria is also set to grow. Moniepoint’s report forecasts that digital health in Nigeria will reach a revenue volume of over $1.3 billion by 2025, with an annual growth rate of 22.31%. This growth is achievable through continued innovation in frontline healthcare, particularly in the adoption of digital solutions.

However, the report also highlights some challenges facing Nigeria’s healthcare system. The country has about 35,000 primary healthcare centers (PHCs), but only 50% are fully registered, licensed, and operational, presenting a significant gap in healthcare infrastructure that needs to be addressed.

The Cost of Starting a Pharmacy in Nigeria

Starting a pharmacy in Nigeria is a costly endeavor, with most entrepreneurs relying on personal savings to fund their businesses. The report shows that 41.9% of pharmacies are funded through personal savings, while loans from family and friends account for 17.9%. Only 17.2% of pharmacies secure loans from banks or financial institutions, with other funding sources including cooperatives (8.2%), gifts from family and friends (7.2%), grants (3.1%), crowdfunding (2.4%), and private equity or venture capital (2.1%).

These figures highlight the need for more accessible financing options for pharmacies, especially as they navigate the shift towards digital payment systems and seek to scale their operations.

Conclusion

Nigeria’s pharmacy sector is undergoing a significant transformation, with digital payments playing a central role in how both businesses and customers operate. The shift to digital channels has been accelerated by events like the 2023 cash crunch, and the trend shows no signs of slowing down. As pharmacies continue to adopt these methods, there is a clear opportunity for growth in Nigeria’s broader digital health market, which is poised to reach $1.3 billion by 2025. However, to fully realize this potential, addressing the gaps in healthcare infrastructure and providing better access to financing will be key for the sector’s long-term success.