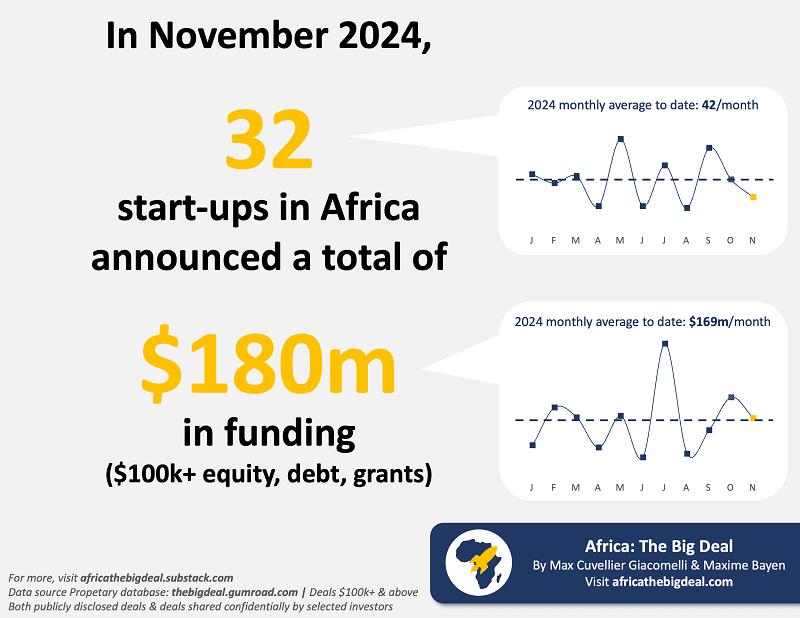

The African startup ecosystem faced a dip in venture funding in November 2024, raising $180 million according to the latest report by Africa the Big Deal, a venture funding analytics platform. This represents a significant 29.1% decline compared to October’s $254 million. However, the November numbers still outperformed September’s $138 million, showcasing the month-to-month volatility in the region’s funding landscape.

Breaking Down the Numbers

A Month of Declines and Gains

While November’s total marks a sharp drop from October, it is a 23.3% increase from September’s haul and a staggering 68.9% rise compared to the $56 million raised in August. These fluctuations reflect both the potential and the unpredictability of Africa’s venture funding environment.

The number of startups securing funding also dropped from 42 in October to 32 in November, signaling a more concentrated allocation of funds among fewer ventures.

SEE ALSO: October 2024: African Startups Garner $254M in Funding, Dominated by Nigerian Fintech

Debt Dominates Venture Funding in November

Debt financing emerged as the dominant funding type, accounting for $122 million or 68% of the total raised in November. This was driven largely by Nigerian solar energy company Sun King, which secured $80 million in debt financing from the International Finance Corporation (IFC). Sun King’s debt raise alone accounted for 44% of the month’s total funding.

Equity funding contributed $55.5 million (31%), while grants made up the remaining $2.5 million (1%).

Notable Startup Deals

Sun King

Nigeria’s solar energy giant, Sun King, led the pack with its $80 million debt raise. The funds are expected to bolster its mission of providing renewable energy solutions across the continent.

Mawingu

Kenyan internet service provider Mawingu raised $15 million through a mix of debt and equity financing. The breakdown included $4 million in equity from InfraCo Africa and Dutch Entrepreneurial Development Bank FMO, and $11 million in debt from the Africa Go Green Fund (AGG). This funding is set to drive Mawingu’s expansion across East Africa.

Djamo

Ivorian fintech startup Djamo secured $13 million in a Series B funding round led by notable investors, including Enza Capital, Oikocredit, Partech Africa, and Y Combinator. The funds will support Djamo’s regional expansion and product development.

The report highlights that Djamo’s raise is only the 7th Series B funding round announced in 2024, a stark contrast to the 14 Series B rounds recorded in 2023.

Country Dominance: Nigeria and Kenya Lead the Pack

Nigeria and Kenya solidified their positions as Africa’s venture funding powerhouses, collectively accounting for 76% of November’s total funding. Both countries continue to attract investor confidence despite a broader decline in funding across the continent.

Acquisitions and Mergers Signal Strategic Moves

November also saw two notable transactions in the African startup space:

- Egyptian ‘contech’ Elmawkaa was acquired by Saudi proptech Ayen, indicating growing cross-border interest in Africa’s construction tech sector.

- SteamaCo and Shyft Power Solutions announced a merger, combining their expertise in energy management solutions to drive growth in sustainable energy technologies.

Year-to-Date Overview: Funding Falls Short of Expectations

As of November 2024, African startups have raised $1.86 billion, falling significantly behind the $2.9 billion raised in 2023. Of this total:

- $1.2 billion (64%) came from equity financing.

- $635 million (34%) was raised through debt.

- $33 million (2%) came from grants.

Despite hopes of reaching the $2 billion milestone by year-end, it remains a tall order as companies begin winding down for the holiday season.

Startups Crossing the $100,000 Mark

So far in 2024, 425 African startups have successfully raised $100,000 or more, reflecting the continued vibrancy of the continent’s entrepreneurial ecosystem even amid broader challenges.

The Road Ahead

While the decline in November funding highlights the challenges African startups face in securing capital, the ecosystem remains resilient. Nigeria and Kenya continue to dominate, and sectors like renewable energy, fintech, and connectivity are attracting significant investments.

As 2025 approaches, the focus will be on leveraging existing resources, fostering cross-border collaborations, and addressing the structural challenges that inhibit growth in Africa’s venture capital landscape. With the right support, African startups are poised to rebound and continue driving innovation across the continent.