Telecommunications companies in Nigeria, acting under the directive of the Nigerian Communications Commission (NCC), are set to cut off 18 banks’ access to Unstructured Supplementary Service Data (USSD) over an unresolved N200 billion debt. This move highlights the growing tensions between banks and telcos, with millions of Nigerians likely to be affected.

What Led to the USSD Debt Crisis?

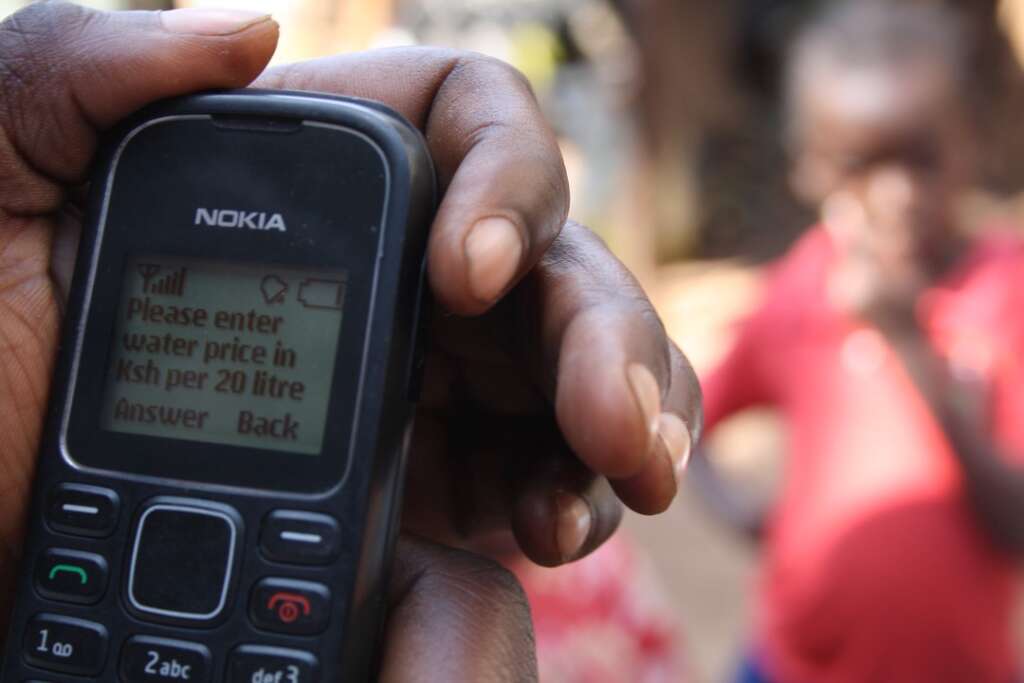

The USSD service, a crucial payment gateway for financial transactions in Nigeria, has seen a surge in use since its introduction. From mobile banking to bill payments, USSD has become an indispensable tool, especially for those in rural areas without access to smartphones or internet banking.

However, since 2019, banks have accumulated a significant N200 billion debt owed to telecommunications operators for the provision of USSD services. This debt issue has persisted despite repeated attempts by both the Central Bank of Nigeria (CBN) and the NCC to mediate and resolve the impasse.

CBN and NCC’s Efforts to Resolve the Debt

To address the growing debt, the CBN and NCC jointly issued a directive in December 2024, mandating banks to clear 85 percent of all outstanding invoices from February 2022. The deadline for compliance was set for December 31, 2024.

Despite the directive, only four banks have complied, leaving 18 others in violation. This non-compliance has pushed the NCC to take decisive action, including the suspension of USSD services for defaulting banks.

SEE ALSO: Telecom-Bank Showdown: NCC and CBN Join Forces to Tackle Mounting USSD Debt Crisis

USSD’s Role in Nigeria’s Financial System

The importance of USSD to Nigeria’s financial ecosystem cannot be overstated. Speaking at the 20th-anniversary celebration of Nigeria’s telecom sector in 2021, Mr. Ebenezer Onyeagwu, the former Group Managing Director of Zenith Bank, said:

“The introduction of USSD changed everything. Without telecoms infrastructure, there is no USSD code.”

Between January and June 2024, USSD transactions were valued at N2.19 trillion. While this represents a significant figure, it also marks a 54.75 percent decline from N4.84 trillion in the same period in 2023. This drop reflects the growing shift among Nigerians toward internet-based transfers.

Impending Suspension: What It Means for Nigerians

The suspension of USSD services for 18 banks is not immediate. According to sources, the NCC plans to issue a two-week public notice before implementing the directive. During this time, affected bank customers will be advised to explore alternative transaction methods, such as mobile apps or internet banking.

The suspension could disrupt millions of daily transactions, particularly for customers in rural and semi-urban areas who rely heavily on USSD for banking and payments.

What’s at Stake for Banks and Telcos?

For Banks:

The suspension of USSD services could significantly impact customer trust and satisfaction, as many depend on this platform for quick and seamless transactions. Non-compliant banks risk losing customers to competitors who remain connected.

For Telcos:

Telecommunication companies are demanding payment for services rendered, and the resolution of this debt is critical for maintaining their financial health and operational capacity. The suspension sends a strong message about the importance of fair business practices.

Why Now? The Broader Implications

The timing of this showdown reflects deeper issues within Nigeria’s financial and telecommunications sectors. The growing preference for internet transfers highlights the need for banks and telcos to collaborate on innovative solutions that address the evolving needs of customers.

However, the inability to resolve the USSD debt threatens the stability of Nigeria’s financial infrastructure. With USSD serving as a bridge for financial inclusion, any disruption could have widespread economic and social consequences.

Looking Ahead: Possible Resolutions

To prevent a crisis, banks and telcos must find a middle ground. Some potential solutions include:

- Revenue-Sharing Agreements: Establishing a clear framework for sharing USSD revenue between banks and telcos.

- Government Intervention: The CBN and NCC may need to introduce stricter enforcement mechanisms or provide subsidies to alleviate the debt burden.

- Customer Education: Encouraging customers to adopt alternative transaction channels like mobile banking apps.

Conclusion: A Call for Collaboration

The looming suspension of USSD services underscores the urgent need for collaboration between banks, telcos, and regulators. By resolving this debt impasse, stakeholders can ensure the continued growth of Nigeria’s financial ecosystem and maintain trust among millions of users who depend on these services daily.

For now, all eyes are on the NCC’s next move and whether the banks will step up to settle their debts before the two-week notice expires.