Nigerian fintech startup Billboxx has secured $1.6 million in a pre-seed funding round to fuel its mission of solving cash flow challenges for small and medium enterprises (SMEs) across Africa. The funds, a combination of debt and equity, were raised from prominent investors including Norrsken Accelerator, Kaleo Ventures, 54 Collective, P2Vest, and Afrinovation Ventures.

This development positions Billboxx as a critical player in Africa’s fintech space, addressing persistent issues such as delayed payments and financial inefficiencies that plague SMEs.

Why Billboxx’s Funding Matters

SMEs are the backbone of Africa’s economy, yet many struggle with cash flow problems due to delayed payments from larger enterprise partners. Billboxx is stepping in to bridge this gap through invoice financing—a service that provides SMEs with advance payments before their clients settle invoices.

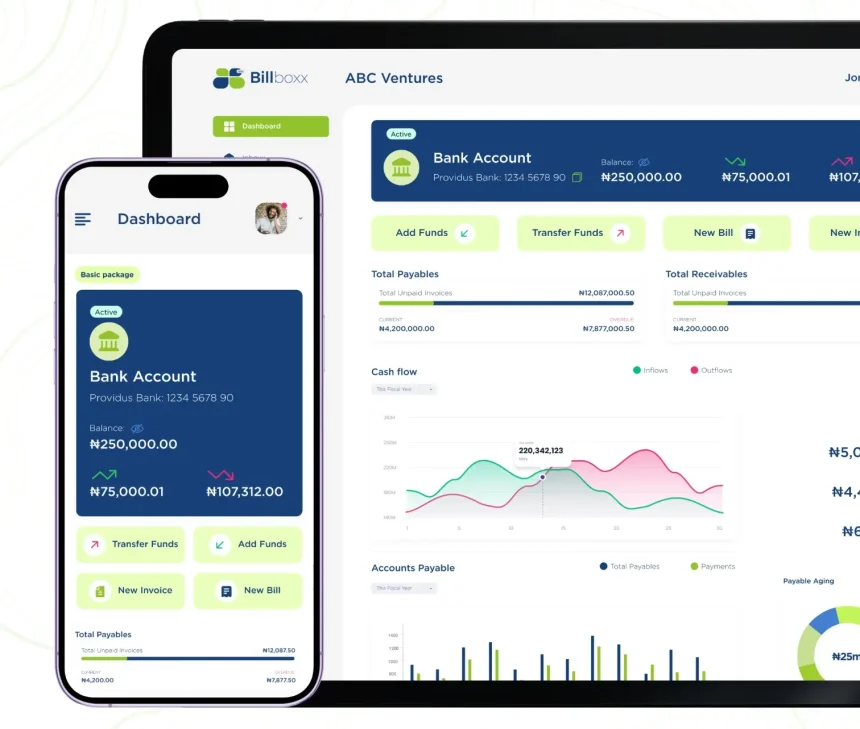

Beyond this, Billboxx offers business banking solutions designed to streamline financial management for SMEs. The startup aspires to be a one-stop financial operating system for smaller businesses, catering to their unique needs and enabling them to scale efficiently.

Key Challenges Facing African SMEs

- Delayed Payments: SMEs often experience weeks or months of delay before receiving payments from enterprise partners.

- Manual Processes: Many SMEs still rely on outdated invoicing methods such as Excel spreadsheets, leading to inefficiencies.

- Limited Access to Financing: Traditional financial institutions often overlook SMEs, leaving them with few options for securing working capital.

Billboxx is tackling these challenges head-on by combining innovative financial products with a deep understanding of SMEs’ operational pain points.

By the Numbers: Billboxx’s Rapid Growth

Since its founding in 2023, Billboxx has shown impressive traction:

- The company processes ₦1 billion ($1.3 million) in transactions monthly.

- Remarkably, it has achieved zero defaults in its financing operations.

- It charges competitive fees, including up to 5% for invoice financing and 1.5% for transactions made on its platform.

These figures underscore the reliability and effectiveness of its financial solutions, setting it apart from competitors.

How Billboxx Works

Billboxx operates by integrating seamlessly with both SMEs and their enterprise partners.

For SMEs

- Invoice Financing: SMEs can access advance payments on approved invoices, ensuring steady cash flow for daily operations.

- Business Banking: Tools for managing transactions, tracking finances, and streamlining billing processes are all available on a single platform.

For Enterprises

- Partnership Model: Billboxx acquires SME clients by collaborating with larger enterprises. Notable clients include Monument Distillers and the International Institute of Tropical Agriculture (IITA).

- Approval Process: SMEs must secure approval from their enterprise clients before their invoices are advanced, minimizing risk and ensuring transparency.

This model creates a win-win scenario, where SMEs get timely payments, and enterprises gain more reliable and financially stable partners.

What They’re Saying

Co-founder Justus Obaoye highlighted the importance of addressing billing inefficiencies for SMEs:

“Every business we interacted with had billing inefficiencies and cash flow problems. Some still use manual or Excel-based invoicing.”

He also outlined the company’s broader vision:

“We plan to become the financial operating system for SMEs in Africa.”

Billboxx is laser-focused on tailoring its solutions for SMEs rather than targeting mid-market or enterprise businesses, ensuring its services are highly relevant and effective.

SEE ALSO: African Startups See Venture Funding Slump in November 2024 Amid Debt Dominance

What’s Next for Billboxx?

With its new funding, Billboxx plans to:

- Scale Operations: Expand its presence across Africa, starting with regions where SME financing is most critical.

- Enhance Product Offerings: Introduce new features, including a platform to connect SMEs with market opportunities within corporate ecosystems. While details remain under wraps, this feature is expected to further bridge the gap between SMEs and enterprise partners.

- Hire Talent: Build a world-class team to support its ambitious growth plans.

Billboxx’s strategic focus on invoice financing and business banking uniquely positions it to drive financial inclusion and growth for SMEs across the continent.

A Promising Future for Africa’s SMEs

The success of Billboxx reflects the growing demand for innovative financial solutions tailored to the needs of Africa’s SMEs. By addressing long-standing issues like delayed payments and limited access to financing, the startup is not only empowering smaller businesses but also contributing to the overall economic development of the region.

As Billboxx continues to expand, its impact on Africa’s SME landscape could serve as a model for other fintech startups looking to make a difference in emerging markets.