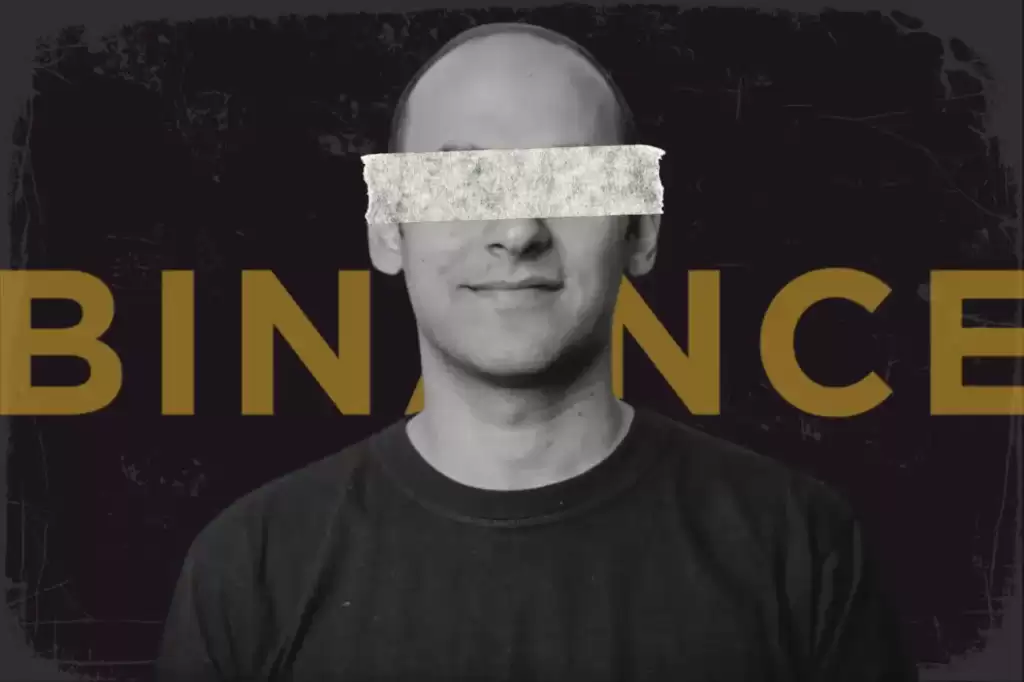

EFCC Amends $35.4 Million Money Laundering Case Against Binance

The Economic and Financial Crimes Commission (EFCC) has amended its $35.4 million money laundering charges against global cryptocurrency exchange Binance and one of its executives, Nadeem Anjarwalla, at the Federal High Court in Abuja. This development marks a significant escalation in Nigeria’s ongoing scrutiny of cryptocurrency activities.

Background: The Case So Far

The case by EFCC against Binance stems from allegations that the company and its executives engaged in laundering $35.4 million, revenue purportedly generated from Binance’s operations in Nigeria. The amended charges follow a dramatic shift in the legal proceedings, including the earlier withdrawal of charges against Tigran Gambaryan, another Binance executive, which ended a prolonged standoff with Nigerian authorities.

Despite these changes, the company’s representative and Anjarwalla were absent at Monday’s trial.

The Allegations

The amended six-count charge, presented before Justice Emeka Nwite, accuses Binance and Nadeem Anjarwalla of the following:

- Money Laundering

- Allegedly laundering $35.4 million in funds suspected to have been generated from illegal proceedings.

- This violates Section 18(3) of the Money Laundering (Prevention and Prohibition) Act, 2022.

- Operating Without a License

- Engaging in financial services activities without a valid license, contrary to Section 58(5) of the Banks and Other Financial Institutions Act, 2020.

- Unauthorized Foreign Exchange Transactions

- Using Binance’s virtual asset services platform to negotiate foreign exchange rates unlawfully.

- This contravenes Section 29(1)(c) of the Foreign Exchange (Monitoring and Miscellaneous Provisions) Act.

Court Proceedings and Pleas

During the trial, EFCC counsel Ekele Iheanacho SAN confirmed the amended charges and highlighted prior agreements between the parties to revise the case after Gambaryan’s discharge. However, the absence of Binance and Anjarwalla meant no plea was entered on their behalf.

In line with Section 478 of the Administration of Criminal Justice Act, Justice Emeka Nwite entered a plea of not guilty for the defendants. This provision mandates that in cases where corporate defendants or their representatives fail to appear, the court must proceed as if a plea of not guilty had been entered.

Next Steps: Trial to Continue in 2025

The court has scheduled the continuation of the trial for February 24–25, 2025, during which cross-examinations and further legal proceedings will take place.

The Bigger Picture: Binance’s Legal and Operational Challenges in Nigeria

This case adds to Binance’s mounting regulatory and legal issues globally. The allegations touch on critical concerns regarding cryptocurrency operations in Nigeria, including compliance with financial and foreign exchange regulations.

Binance’s regulatory troubles have led to growing suspicion about its operations. The exchange has announced plans to halt USD withdrawals and deposits globally by February 8, 2025, a move that has raised eyebrows among industry watchers.

Implications for the Cryptocurrency Industry

- Regulatory Scrutiny Intensifies

- The case underscores Nigeria’s focus on regulating digital asset platforms to curb illicit financial flows.

- It signals a warning to other cryptocurrency platforms operating in the country to ensure full compliance with local laws.

- Impact on Binance’s Reputation

- Repeated allegations of regulatory violations may affect Binance’s trustworthiness among Nigerian users and global stakeholders.

- Future of Cryptocurrency in Nigeria

- Nigeria remains one of Africa’s largest cryptocurrency markets, but cases like this may deter innovation and adoption if regulatory clarity is not established.

Looking Ahead

As the trial resumes in early 2025, the case against Binance and its executives will likely set a precedent for how Nigerian authorities handle cryptocurrency-related violations. Whether Binance can weather this storm or faces severe consequences remains to be seen, but the case underscores the growing tension between crypto innovation and regulatory enforcement in emerging markets.