Businesses in emerging markets often encounter challenges that limit their growth, even when they’re registered in global hubs like the US, UK, or EU. Restricted access to essential financial services, unpredictable account closures, and compliance barriers are just a few of the hurdles these businesses face. Enter Waza’s Lync, a groundbreaking platform designed to unlock global commerce for businesses in emerging markets. With cutting-edge features and robust financial tools, Lync aims to bridge the gap and empower companies to thrive on the international stage.

Driving the News: What is Lync?

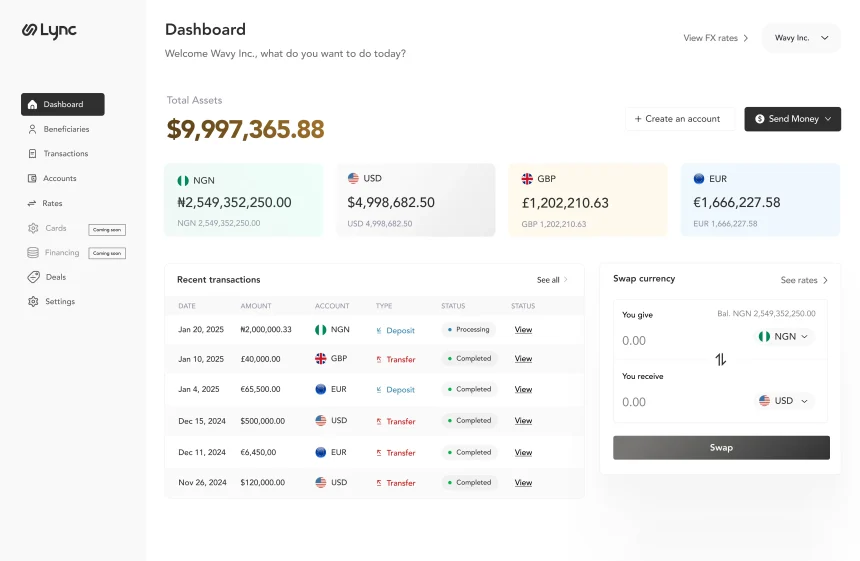

Lync is Waza’s newly launched multi-currency account platform that combines powerful foreign exchange (FX) liquidity solutions with an intuitive banking experience. Businesses can use Lync to manage transactions in USD, EUR, GBP, NGN, and even Stablecoins, enabling payments to over 100 countries seamlessly.

Key Features of Lync:

- Fully functional accounts with ACH, Fedwire, SWIFT, and local payment rails like the UK’s Faster Payments system.

- FDIC-insured funds for maximum security.

- Competitive FX rates to streamline international payments.

- A comprehensive suite of tools to optimize cash flow and global transactions.

The Problem: Barriers Facing Emerging Market Businesses

Emerging market companies often struggle to scale due to arbitrary compliance thresholds, unexpected account restrictions, and limited access to global financial systems. These challenges hinder their ability to compete and grow in the global market.

The Solution: How Lync Changes the Game

Lync provides a one-stop solution for businesses to:

- Manage multi-currency accounts with ease.

- Secure funds with FDIC insurance, providing peace of mind.

- Access competitive FX rates for better financial planning.

- Conduct smooth cross-border transactions using international and local payment rails.

With these features, Lync eliminates barriers and offers businesses the tools they need to scale globally.

Zooming In: Waza’s Impressive Growth and Milestones

Since its stealth launch in January 2023, Waza has shown exponential growth:

- $700 million in annualized payment volume processed.

- Monthly growth of 20%, reflecting strong market demand.

- Raised $3 million in seed funding and $5 million in venture debt to scale operations.

What They’re Saying

SEE ALSO: Prosper Africa and Afreximbank Join Forces to Boost Trade Between U.S and Africa

Maxwell Obi, CEO and Co-founder of Waza, shared the vision behind Lync:

“We created Lync to empower businesses to overcome longstanding financial barriers and drive sustainable growth. This platform will unlock opportunities for businesses to scale, optimize cash flow, and reach new markets.”

The Big Picture: Who Benefits from Lync?

Lync is designed for businesses with global operations, including large enterprises, technology firms, and companies expanding internationally. It’s especially suited for organizations conducting frequent cross-border transactions or managing multi-currency operations.

What’s Next for Waza?

With a strong foothold in African markets like Nigeria and Ghana, Waza plans to expand its reach to other regions, enabling seamless global commerce for a broader range of businesses.

Conclusion: Transforming Global Commerce for Emerging Markets

Lync’s platform is more than just a financial tool; it’s a lifeline for businesses in emerging markets seeking to break into the global economy. By addressing the challenges that have long held these companies back, Lync is setting a new standard for financial accessibility and efficiency.

For businesses in emerging markets, the future is bright—and Lync is leading the way.