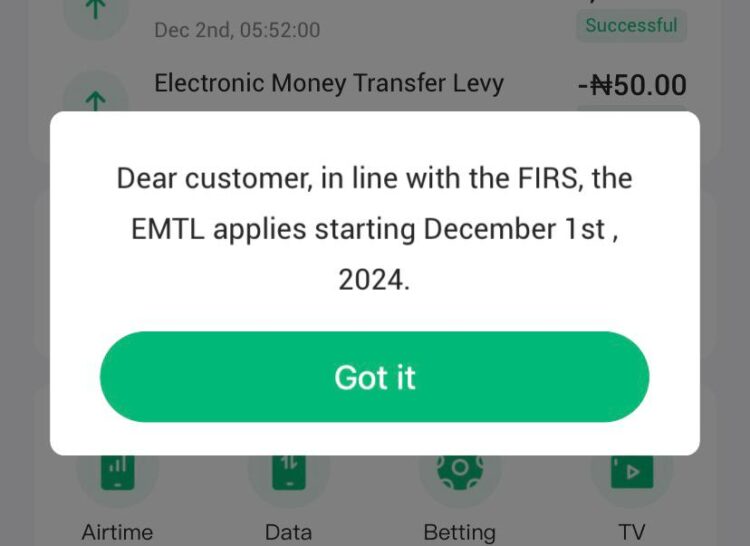

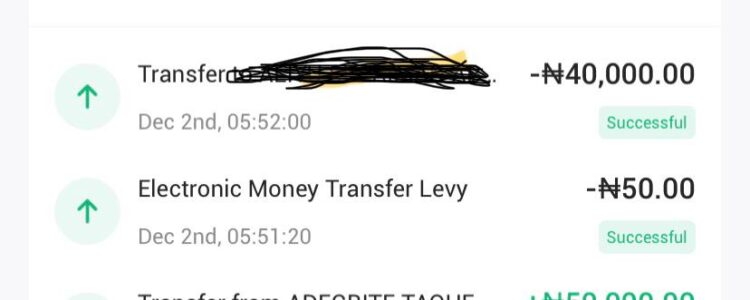

The introduction of the Electronic Money Transfer Levy (EMTL) by the Nigerian government has stirred significant public outcry. The N50 charge, now extended to fintech platforms like Opay, Moniepoint, and Palmpay, applies to transactions above N10,000, a move that has sparked intense debate. While fintechs have revolutionized financial services by offering low-cost, accessible options to millions of Nigerians, this levy threatens to undermine the affordability and convenience they bring.

A Burden on Already Strained Nigerians

Nigeria is grappling with economic hardship, skyrocketing inflation, and a depreciating naira, making daily living increasingly unaffordable for the average citizen. The N50 levy on transactions might seem minor to some, but for many Nigerians, it represents yet another financial burden.

Students, small business owners, and individuals who rely on digital transfers for everyday transactions are particularly affected. With many families already struggling to make ends meet, the levy feels like an unnecessary and insensitive imposition during a period of national economic crisis.

SEE ALSO: CBN Reduces Cybersecurity Levy on Electronic Transactions Amidst Backlash

Fintechs: A Lifeline for Many

Platforms like Opay, Palmpay, and Moniepoint have become lifelines for Nigerians seeking alternatives to traditional banks, which have often been criticized for high fees and poor customer service. These fintechs brought innovation, efficiency, and accessibility, allowing millions to perform transactions quickly and affordably.

However, with the EMTL now extending to these platforms, the era of free or low-cost banking services is effectively over. This move could erode the trust and reliance Nigerians have placed in fintech companies.

A Government Revenue Tool or Exploitation?

The government defends the levy as a necessary measure for revenue generation, citing the Finance Act 2020 as its legal basis. Yet, many Nigerians question the timing and implementation of this policy. The perception is that this is another way for the government to “milk” its citizens, especially when little transparency exists about how collected taxes are utilized.

Critics argue that rather than imposing additional levies, the government should explore other revenue streams, such as improving tax collection efficiency, reducing corruption, and boosting sectors like agriculture and manufacturing.

Public Outcry and the Call for Change

The outcry on social media has been loud and clear. Many Nigerians have taken to platforms like X (formerly Twitter) to express their frustrations. One user highlighted a workaround to avoid the charges by splitting transfers into smaller amounts, showcasing citizens’ determination to resist additional financial burdens.

The National Association of Nigerian Students (NANS) has also condemned the levy, emphasizing its detrimental effects on students who rely on digital transfers for their education and daily needs. NANS called on the government to reconsider, urging it to prioritize citizen welfare over revenue generation.

Will the Government Listen?

The critical question remains: will the government listen to the cries of its citizens? Or is this policy a sign of a deeper disconnect between policymakers and the everyday struggles of Nigerians?

As the EMTL deduction continues, the government faces mounting pressure to address public concerns. The introduction of this levy risks not only financial strain for citizens but also a potential backlash against a government already struggling with issues of public trust and credibility.

The ball is now in the government’s court to prove whether it genuinely prioritizes the welfare of Nigerians—or if this is simply another move to squeeze citizens for revenue in the midst of economic despair.