Fraud remains a significant threat to Nigeria’s financial sector, with a staggering 11,500 fraud cases reported in Q2 2024 alone, involving a total of ₦56.3 billion—a 1,784.94% increase from Q1. Losses rose to ₦42.6 billion, marking an 8,993.04% spike. Mobile, web, and POS fraud remain the most pervasive, with staff involvement in fraud cases seeing a sharp 23.40% increase from the previous quarter, according to the Financial Institutions Training Centre (FITC).

Amidst this alarming trend, PalmPay, a leading digital financial platform in Nigeria, has taken proactive measures to combat fraud and secure financial systems through awareness, collaboration, and education.

PalmPay’s Anti-Fraud Initiative

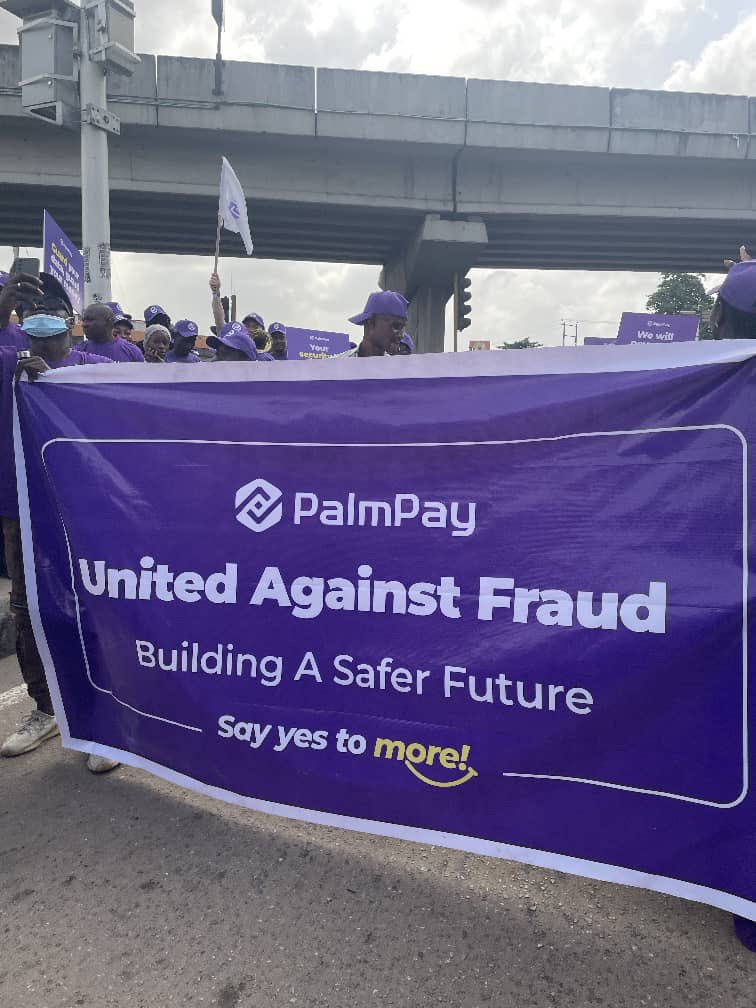

In recognition of the 2024 International Fraud Awareness Week, PalmPay organized a community walk in Lagos on November 22, themed:

“United Against Fraud: Building a Safer Future.”

SEE ALSO: Your Money Is No Longer Safe With Opay, Palmpay. This Is Why

The initiative focused on educating the public about fraud prevention and enhancing digital security. Speaking at the event, PalmPay’s Managing Director, Chika Nwosu, emphasized the systemic threat posed by fraud:

“Fraud is more than just a crime—it is a systemic threat that undermines trust, compromises security, and disrupts progress. These figures are more than numbers; they represent real people whose trust has been broken and whose finances have been compromised.”

Educating Nigerians on Fraud Prevention

PalmPay’s campaign provided practical tips for fraud prevention, including:

- Safeguarding personal information.

- Avoiding suspicious links and emails.

- Reporting suspected fraud immediately.

Chika Nwosu highlighted the platform’s commitment to user security, stating:

“We have built a robust system that cannot be penetrated by fraudsters, but the public must also avoid compromising their identity.”

PalmPay also emphasized the importance of reaching underserved communities, especially where ATMs are scarce. With 70% of urban ATMs experiencing cash shortages—and rural areas even worse—POS agents play a critical role in bridging the financial inclusion gap.

Collaborating with Stakeholders

PalmPay is actively partnering with law enforcement, including the EFCC and the Nigerian Police Force, to tackle fraudulent activities:

“We maintain a close relationship with all security agencies. Whenever there is an issue, we provide them with the necessary information promptly to address fraudulent activities,” Nwosu explained.

By fostering collaboration and rapid response to fraud cases, PalmPay aims to build trust and ensure a secure financial ecosystem for all users.

Towards a Safer Financial Ecosystem

PalmPay’s anti-fraud initiative signals its dedication to tackling one of Nigeria’s most pressing financial challenges. The fintech company plans to expand its campaigns nationwide, reinforcing its mission to promote safety, trust, and inclusion in Nigeria’s rapidly evolving digital economy.

Together with stakeholders, PalmPay seeks to create an environment where businesses and individuals can thrive without fear, paving the way for a secure and prosperous digital future.