Payoneer, a leading online finance company, has recently announced a significant update that will allow its users to accept PayPal payments from US clients on its platform. This new feature is set to provide greater flexibility and convenience for users, particularly freelancers and small business owners who rely on international transactions. However, there are important details and limitations that users need to be aware of.

How It Works

Payoneer users can now send payment requests to their clients, who will have the option to select PayPal as their payment method. This integration aims to streamline the payment process, making it easier for Payoneer users to receive funds from US-based clients who prefer using PayPal.

The Catch: Requirements for New Users

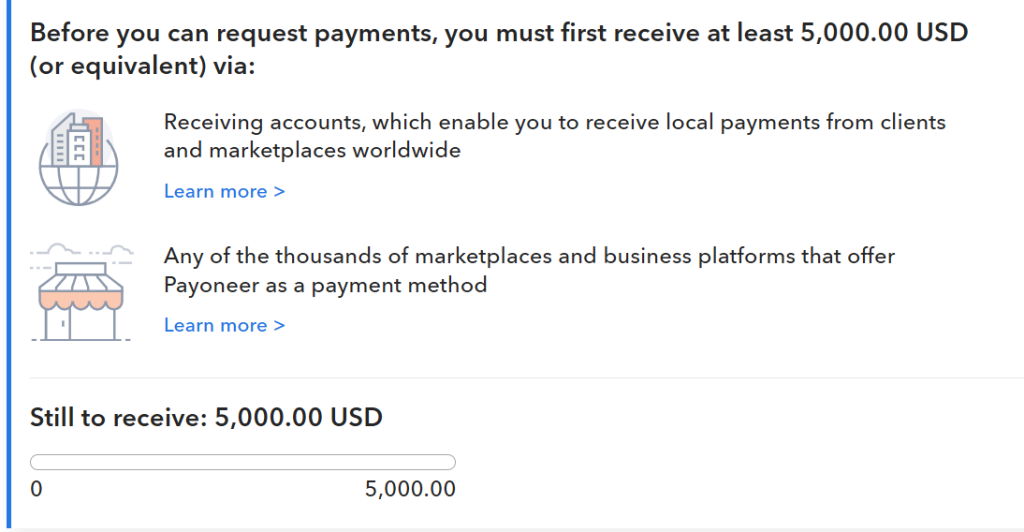

For new Payoneer users, gaining access to request payments from US-based clients via PayPal is not as straightforward as it might seem. According to Payoneer’s policy, new users must first accumulate $5,000 in their Payoneer account through various means before they can activate this feature. These methods include receiving payments from trusted sources such as Buy Me a Coffee, Fiverr, and Upwork. This requirement ensures that the user has a verified and active account, which is crucial for maintaining security and compliance standards.

Historical Context and Regional Challenges

This development comes against a backdrop of regional challenges and unmet expectations related to PayPal’s availability. In 2019, Vice President Mahamudu Bawumia of Ghana announced that PayPal services would be available in Ghana by the second half of the year, with full functionality expected by early 2020. Unfortunately, these plans did not materialize, leaving many Ghanaians unable to access PayPal services directly.

Zooming out further, it’s important to remember that in 2004, PayPal blacklisted Ghana, Nigeria, and several other sub-Saharan countries due to high levels of credit card fraud. While Nigeria was removed from this blacklist in 2014, Ghana remains excluded, significantly affecting the ability of its residents to conduct international transactions through PayPal.

Alternative Solutions for International Payments

Given the limitations and challenges associated with using PayPal and Payoneer, particularly for new users or those in regions like Ghana, there are several alternative solutions available for receiving payments from US clients. Local fintech companies such as Paystack and Flutterwave offer robust platforms for international payments, providing reliable alternatives for those unable to use PayPal directly.

Additionally, remittance platforms such as LemFi, Sendwave, WeWire, and Remitly offer other viable options for US clients to remit payments to recipients abroad. These services often provide competitive rates and quick transfer times, making them suitable for individuals and businesses alike.

READ ALSO: What You Need To Know About Flutterwave Partnership with EFCC

While Payoneer’s new feature enabling PayPal payments from US clients is a welcome development, it comes with specific prerequisites that users must meet. Understanding these requirements and exploring alternative payment options can help users navigate the complexities of international transactions more effectively. As the landscape of digital payments continues to evolve, staying informed about available services and their conditions is essential for maximizing financial operations in the global marketplace.