Overview of the USSD Debt Crisis

The Nigerian Communications Commission (NCC) and the Central Bank of Nigeria (CBN) are working together to address a growing financial dispute over Unstructured Supplementary Service Data (USSD) services. This partnership reflects the urgent need to resolve the significant debt burden that has strained relationships between telecommunications operators and Deposit Money Banks (DMBs).

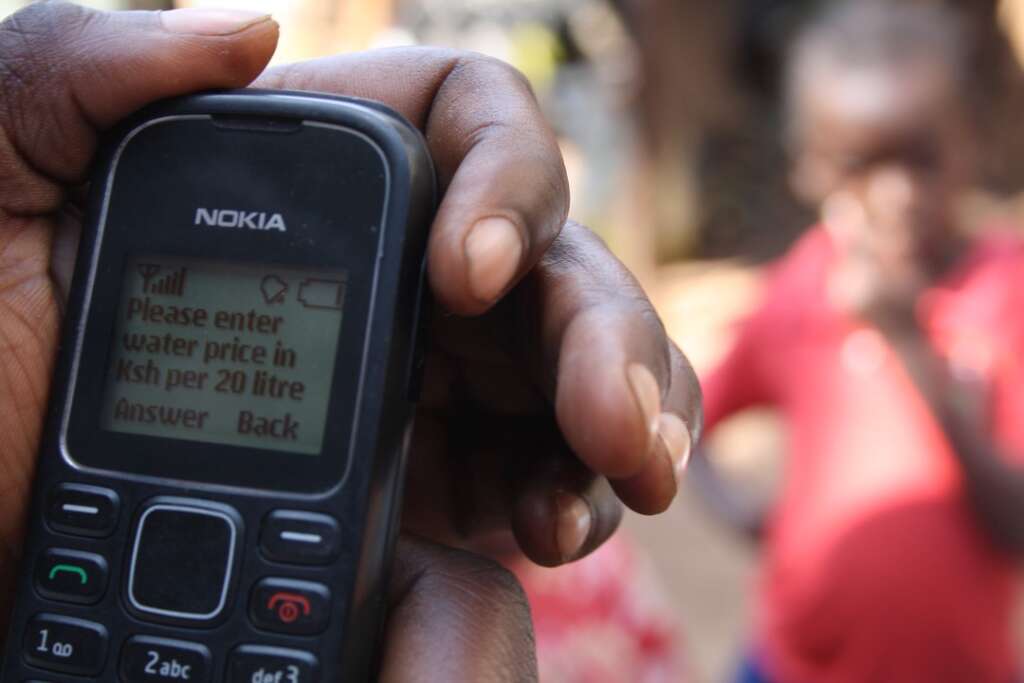

The USSD protocol, a vital component of GSM networks, facilitates essential services such as mobile banking, balance checks, and utility bill payments. Despite its importance, disputes over service fees and payment structures have created a financial standoff, threatening the seamless operation of this critical technology.

How the Debt Crisis Unfolded

The debt crisis stems from disagreements about the pricing and settlement mechanisms for USSD services.

- Unpaid Fees: Telecom operators claim that banks owe billions of naira in unpaid USSD charges, while banks argue that high tariffs imposed by telcos are unsustainable.

- Usage Growth: The surge in USSD usage during the COVID-19 pandemic amplified these disputes, as more Nigerians relied on digital financial transactions.

- Policy Challenges: Previous attempts by regulators to mediate, such as introducing a flat rate of ₦6.98 per USSD session, have not completely addressed the underlying issues.

As of 2024, the cumulative debt owed to telcos by banks has reportedly exceeded ₦100 billion, threatening the sustainability of USSD services in Nigeria.

NCC and CBN’s Joint Initiative

Recognizing the critical role USSD plays in Nigeria’s financial ecosystem, the NCC and CBN have initiated a collaborative framework to resolve the crisis.

Goals of the Partnership

- Debt Reconciliation: Establishing a transparent process to verify and reconcile outstanding debts.

- Fair Pricing: Developing a pricing structure that is equitable for both banks and telecom operators while ensuring affordability for end users.

- Sustainability: Creating policies that guarantee the long-term viability of USSD services.

Planned Actions

- Stakeholder Engagement: Regular meetings between telcos, banks, and regulators to address grievances and foster collaboration.

- Technology Audits: Assessing USSD systems to identify inefficiencies or bottlenecks in service delivery.

- Public Communication: Launching campaigns to educate users about the importance of USSD and any changes in pricing or service delivery.

The Importance of USSD in Nigeria’s Economy

USSD has become a backbone of financial inclusion in Nigeria, especially for rural and underserved populations without access to smartphones or internet connectivity.

- Accessibility: Over 60% of Nigerians rely on USSD for basic financial transactions.

- Cost-Effectiveness: USSD is cheaper than most mobile banking apps, making it a preferred option for low-income earners.

- Financial Inclusion: By enabling seamless transactions, USSD supports the CBN’s drive toward a cashless economy and improved financial literacy.

Any disruption to USSD services would disproportionately affect the country’s unbanked population, potentially reversing gains in financial inclusion.

SEE ALSO: Why 9Mobile Lost 90% of Its Customers and Gained Only 30 New Ones

Challenges in Resolving the Crisis

While the NCC and CBN’s intervention is a step in the right direction, several challenges remain:

- Revenue Sharing Disputes: Aligning the interests of telcos and banks on revenue sharing requires delicate negotiations.

- Consumer Impact: Ensuring that the resolution does not result in higher costs for end users.

- Enforcement: Regulatory bodies must ensure compliance with any new agreements.

What Lies Ahead

The NCC and CBN’s collaboration signals a renewed commitment to addressing the USSD debt crisis, but its success will depend on the willingness of all stakeholders to compromise. A lasting solution could pave the way for enhanced digital financial services in Nigeria, bolstering economic growth and financial inclusion.

Key Expectations

- Debt Resolution by 2025: Regulators aim to resolve outstanding debts and prevent further accumulation.

- Strengthened Policies: New policies may emerge to streamline service delivery and prevent future conflicts.

- Innovation in USSD Services: The crisis may drive innovation, with stakeholders exploring alternative technologies or business models.

Conclusion: Building a Sustainable Future for USSD

The NCC and CBN’s intervention is a pivotal moment in the ongoing struggle to balance profitability, accessibility, and sustainability in Nigeria’s digital economy. As the regulators work to broker peace between telecom operators and banks, Nigerians are hopeful for a resolution that safeguards the essential USSD services relied upon by millions.

The outcome of this collaboration will not only shape the future of mobile banking in Nigeria but also set a precedent for resolving similar disputes in other sectors.