The Debt Battle: Banks vs. Telecom Operators

Nigeria’s banking and telecommunications sectors have been embroiled in a payment dispute over Unstructured Supplementary Service Data (USSD) charges, leaving a significant debt of N160 billion unpaid since 2019. The Nigerian Communications Commission (NCC) recently intensified efforts to recover this debt, setting a firm deadline of January 27, 2025, to cut off USSD access for nine defaulting banks.

The affected banks include Fidelity Bank Plc (770), First City Monument Bank (329), Jaiz Bank Plc (773), Polaris Bank Limited (833), Sterling Bank Limited (822), United Bank for Africa Plc (919), Unity Bank Plc (7799), Wema Bank Plc (945), and Zenith Bank Plc (966). As the clock ticks, the financial institutions are scrambling to avoid losing access to a service that millions of Nigerians rely on daily for banking transactions.

A Glimmer of Compliance: Partial Payments Begin

Following the NCC’s public warning on January 15, 2025, there has been some movement. According to an NCC insider, at least five of the nine banks have made partial payments to reduce their outstanding debts. “Only four or less are yet to pay. They are responding. Banks have been responding since the advert came out,” the source revealed.

While this is a positive development, it is far from resolution. Another industry source confirmed that although payments have been made, a significant portion of the debt remains unsettled.

A Looming Disconnection: What It Means for Nigerians

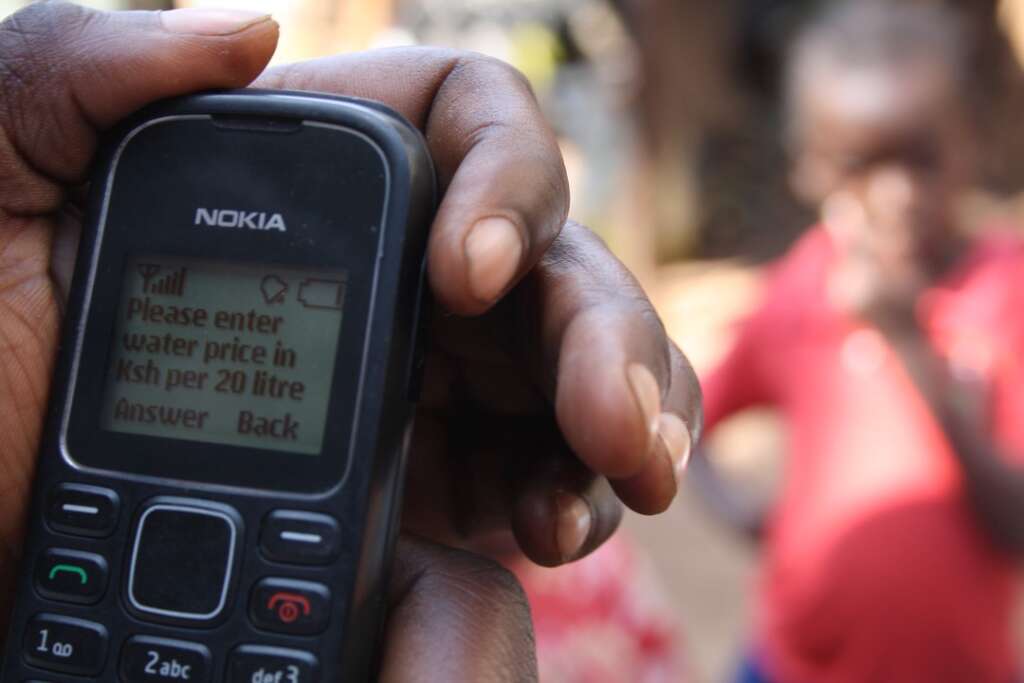

USSD is a critical platform that bridges the financial inclusion gap in Nigeria. It allows millions of users—many without smartphones or reliable internet access—to perform essential banking transactions like transfers, bill payments, and balance checks.

The NCC’s notice warns that starting January 27, consumers may be unable to access the USSD services of defaulting banks. This disconnection will disrupt financial activities for millions of Nigerians, especially in rural areas where USSD is a lifeline.

“In fulfillment of its consumer protection mandate, the Commission wishes to inform consumers that they may be unable to access the USSD platform of the affected financial institutions from January 27, 2025,” the NCC stated.

The CBN-NCC Push for Resolution

Efforts to resolve the payment standoff have been ongoing since 2019, with limited success. In December 2024, the Central Bank of Nigeria (CBN) and the NCC issued a joint circular, mandating banks to pay 85 percent of all outstanding USSD invoices (from February 2022) by December 31, 2024. Despite this directive, only nine of the 18 indebted banks managed to clear over 90 percent of their dues.

“The financial institutions’ failure to comply with the CBN-NCC joint circular also means that they are unable to meet the Good Standing requirements for the renewal of the USSD codes assigned to them by the Commission,” the NCC emphasized.

Why the Debt Remains Unresolved

The debt crisis stems from a disagreement over who should bear the cost of USSD services. Telecom operators argue that banks have been using their infrastructure for years without adequate compensation, leading to the staggering debt. Banks, on the other hand, have expressed concerns about the high charges levied by telcos.

This unresolved dispute has caused friction, with both sectors accusing each other of bad faith. Despite interventions from regulators like the CBN and NCC, the problem persists, highlighting deeper structural and operational challenges.

SEE ALSO: Banks vs. Telcos: Nigeria’s N200 Billion USSD Debt Showdown

Industry Experts Weigh In

Industry analysts believe that more banks are likely to comply with the NCC’s January 27 deadline to avoid being cut off. Losing USSD access would not only inconvenience customers but also tarnish the reputation of defaulting banks. “No bank wants to be seen as the reason millions of Nigerians are locked out of financial services,” an expert noted.

However, there are concerns that partial payments may not be enough to prevent disconnection. Without a comprehensive resolution, the debt crisis could escalate, further straining relations between the banking and telecom sectors.

What Lies Ahead

With just days to go until the deadline, all eyes are on the remaining defaulting banks. Will they make the necessary payments to avoid disconnection? And if not, how will this affect Nigeria’s financial ecosystem?

One thing is certain: the NCC’s firm stance signals a shift towards holding financial institutions accountable for their obligations. Whether this results in a long-term resolution or a temporary fix remains to be seen.

For now, millions of Nigerians anxiously await the outcome, hoping for uninterrupted access to the banking services they depend on every day.